A Special Note Regarding Your Privacy: We will NEVER email, text, or otherwise contact you and ask you for your username, password, account number, Social Security number, or other financial credentials. If you should receive a call, email, or text asking for this information, do not respond. Please let us know immediately by calling your local branch.

Helping You Avoid Scams

Easy Money or Money Mule?

A money mule acts as a layer of distance between a scammer and their victims by handling stolen funds on behalf of someone else, either knowingly or unknowingly. Money mules make a scam harder to trace and the money harder to find.

Beware of offers that promise quick cash or a commission in exchange for receiving money and then sending it to someone else. This may take the form of a fake job opportunity, investment scheme, or prize award.

As an example, the scammer may approach an unsuspecting victim online or by phone with the promise of a financial windfall. In some cases, they may send the person a lump sum, ask them to transfer a portion of it to another account, and keep the rest for themselves. It sounds like easy money, but acting as a money mule is illegal, even if the person is unaware they are committing a crime.

Another tactic is for a scammer to say that they’re unable to receive funds through a particular payment method and need someone else to help by accepting a payment into their bank account. In reality, they are scamming someone out of funds and using another person as a middleman to help cover their tracks. After the money transfers are completed, the money mule could be held criminally responsible for their participation, whether they knew it was a scam or not.

Protecting Yourself from Money Mule Scams

It’s important to only send and receive money with those you know and trust. If a stranger requests that you handle money for them, stop communicating with them immediately. If you find that an unexpected deposit has been made in your account and a stranger calls and claims it belongs to them, hang up and contact your financial institution to report it.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Identify and Defend Against Military Scams

Being away from home on a deployment is a challenging time for military members and their families, and some people try to take advantage of these situations, making things even more stressful.

A military scam begins when a scammer gains access to deployment, relocation, or public information. Then they use this data to try to convince their targets – armed services members or their loved ones – to send money right away.

Common Scams and Tactics

A scammer may call, email, or text an urgent request for money via a wire transfer or digital payment platform. These schemes can take many forms, including:

- Fake debt collectors with urgent notices.

- Donation requests from fraudulent charity organizations that claim to help members of the military.

- Fees for grant applications from government agency imposters.

- A person pretending to be—or represent—a deployed service member in desperate need of money. In reality, the criminal is trying to create a sense of urgency or tug on your heartstrings to get you to respond with emotion.

Ways to Avoid Scams

Any time you receive a request for money or personal information, take a moment to evaluate the situation and make sure there are no red flags. This includes doing research on any organization or company that you’re not familiar with. If something seems off, dig in and ask questions. A legitimate debt collector or charity will take the time to answer any questions.

Also, consider the payment method they are asking for. Wire transfers and digital payment platforms often can’t be reversed once the payment has been sent, so if the requestor is demanding these forms of payment, it might be a red flag.

If a loved one sends a text message from a number you don’t know, and they say they need money quickly, ask them a personal question only they would be able to answer. This is an effective way to verify their identity and protect against imposters. You may also want to check in with family and friends to see if others have received similar communication.

When it comes to your finances, always slow down and ask yourself questions.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Protect Your Small Business from Payment Scams

It is often assumed that payment scams only happen to individuals, but small businesses are also frequent targets for scammers. These maneuvers can often go unnoticed because the scam is embedded within typical business operations. The best line of defense is knowing what to look for.

Here are three types of scams targeting small businesses:

Fake Invoices. A scammer will send a fake invoice hoping to trick a business owner, or one of their employees, into paying for products or services they never ordered or received. Their hope is that the invoice will blend in with the others and will be paid without anyone giving it a second look. The fake invoice could be for office supplies, domain hosting or other services, and it can arrive via email or regular mail.

Intentional Overpayments. A customer overpays for a product or service. That may not sound like a scam, but it can be. After overpaying with a check or credit card, the scammer contacts the business with an apology for the overpayment and asks for a refund of the excess amount through a digital payment, pre-loaded debit card, or a wire transfer. After the refund is completed, the business owner discovers that the original check has bounced, or the credit card used for the purchase was stolen. Now the business has issued a refund for a payment they never actually received.

In another scenario, the scammer claims to make an online payment for more than the amount due. They present a fake receipt for the purchase and claim that the funds are being held by the payment provider until the overpaid amount has been refunded. Like the scenario above, after the refund is issued, the original payment never comes through.

Office Supply Scam. A business receives an unexpected phone call from someone claiming to represent a reputable office supply company, perhaps one there is already an existing business relationship with. The caller tries to sell surplus merchandise at a reduced price, citing a cancellation or over-order by another purchaser. A payment is made, but the merchandise never arrives.

Here are ways businesses can protect themselves from these types of scams:

- Pay close attention to invoices and other requests for payment. Make sure items have been received and services completed. Check with employees to verify who placed the order and confirm the payment should be processed.

- Conduct regular audits of all financials and keep documentation for all orders and purchases. This will help to detect fake accounts and invoices.

- Establish payment authorization procedures, including a multi-person approval process for transactions above a certain dollar amount.

- Understand your payment options. Digital payments can be quick and efficient, but when purchasing goods or merchandise, a credit card may be a better option. Many credit card companies offer built-in buyer protections for cardholders. Check the terms and conditions of your credit card to see what’s offered. Avoid paying any vendor using pre-paid debit cards and gift cards, which can be untraceable if the vendor doesn’t fulfill their commitment.

- Educate employees. If the staff knows about these scams, they’ll be more likely to spot one and avoid falling victim.

Above all, slow down and ask questions. Never be rushed into making a payment. Urgency is a tactic scammers use to steal money before the victim has time to think it through.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Online Dating and Virtual Relationships Can Lead to Romance Scams

They say "love is blind." This is especially true when it comes to looking for love online. Unfortunately, the popularity of online dating has created a new avenue for scammers to embed themselves into people’s daily lives with fake profiles and phony promises. Romance scams are growing in popularity, so if you are looking to meet someone online make sure you are not blinded by love and will notice if something seems fishy.

How Romance Scams Work

Scammers create fake profiles that are aimed at gaining your affection and trust. They may have an unusually high number of similar interests, and once you engage with them, they will contact you frequently with intense flattery to establish a quick relationship. The only caveat is that they can’t meet in person. They will provide excuses such as serving in the military or other remote commitments. After spending weeks – or months – building a connection with you, they will ask for money, typically through an electronic payment method that is fast and cannot be reversed. Common reasons include travel expenses to finally come see you, medical emergencies, or debt relief to start a new life together. They will make promises about the future, but if you refuse, they'll threaten your relationship and stir up guilt until you finally agree. This may take place during times when many people feel lonely, such as Valentine’s Day or during the holidays. After you send the requested money, the scammer will disappear.

What You Can Do If a Scammer Targets You

If you suspect an online romance seems suspicious, make sure you slow down and ask questions. Try doing a Google image search with their photos to make sure they are not random pictures the scammer found online. If you believe you may be interacting with a scammer, report the user to the platform where you first made contact, and do not send them any money.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Protect Your Savings from Investment Scams

We all dream of financial success, but when it comes to investing, we have to be cautious. Scammers will tout a once-in-a-lifetime opportunity that will earn high returns with little to no chance of loss. These investment scams take a variety of forms, from financial coaching and management schemes to cryptocurrency and fake investment companies. After the unsuspecting investor sends their money, the other person disappears, and the money is gone.

Signs of an Investment Scam

A scammer may post an ad online – or contact you via phone, text, or email with an unsolicited offer – that seems too good to be true. But there are some red flags you can look for that may indicate the opportunity is actually a scam.

- No Risk of Loss. Be wary of opportunities that advertise a way to make easy money fast and promise financial security for years to come. Typically, all investments require some level of risk.

- Use of Pressure Tactics. You might see an "exclusive offer" to join a program for a limited time. This is a pressure tactic designed to rush you into making a decision without thinking it through or fully vetting the opportunity.

- Upfront Payment Is Required. If an investment opportunity requires you to send money upfront through cryptocurrency or a digital payment method, don't engage.

Ways to Avoid an Investment Scam

If you think a scammer may be targeting you, remember to slow down and ask questions. If something seems too good to be true, it probably is. Pay close attention to the details and do thorough research before making any financial decisions. You can also contact the Better Business Bureau and any applicable government agencies to see if other consumers have filed complaints against the individual or company.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Beware of the Seemingly Perfect Rental. It Could Be a Scam.

You finally found a rental property to call home. It's the perfect location, the pictures look amazing, and the price is much lower than you were expecting to pay. All you need to do is send the landlord a deposit and the first month's rent to seal the deal.

STOP! Before you do that, make sure you're not sending money for a property that doesn't exist. Rental scams are yet another opportunity for scammers to steal money. These scams target both new and existing renters, so it's important to know what to look for.

Tips for Spotting a Rental Scam

Pictures Look Too Good. If a picture shows a beautifully renovated rental at a price that's well below market rate, be cautious. Glamour photos can easily be found online. Reverse search an image by right clicking.

Listing Has Errors. Scammers are smart but very often don't have very good grammar. Listings that have grammatical mistakes and other formatting errors could be signs of a scam.

Pressure to Sign & Pay Right Away. A legitimate landlord or rental agent will typically show you a space before renting it. If an agent is pressing you to sign a contract or pay a deposit without seeing the property first, this is a red flag. Especially if they insist you pay with a digital payment platform like Zelle® or Venmo.

There's No Credit Check. Landlords and rental companies typically conduct a credit check to determine if a renter is creditworthy. While some places don't require a credit check, be careful. Ensure the agent is not taking advantage of your need for housing by offering a fictitious home with lenient eligibility requirements.

Ways to Avoid Rental Scams

Always ask to tour the property. Don't rent a place without seeing it. Schedule a time to tour the property to make sure it exists and looks like the advertisement.

Skip listings that look suspicious. Scroll past spam listings and be skeptical of listings that are priced well below market or contain grammatical and spelling errors.

Don't send money in advance. You should never be charged a fee to tour a property, so turn away from any request for an upfront payment. Avoid sending any seemingly legitimate payment like a security deposit or first month's rent without seeing the space and meeting the landlord or property manager. If the landlord comes up with a convincing story as to why they can't meet, it's best to wait.

Slow down and ask questions. Don't allow yourself to be bullied or pressured. If you do, you could be playing right into the hands of a scammer. Take your time, see the property for yourself, and ask all the necessary questions to make sure this is the place for you.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

How to Determine if a Donation Appeal is Real – or a Scam

Charitable donations are a great way to make an impact on the causes you care about. But when tragedy strikes, scammers may prey on the generosity of those trying to support the victims. Scammers request donations on social media or crowdfunding websites – or contact you by phone, text, or email.

Common Characteristics

Charity scams occur when a scammer tricks people into sending them money for what they believe is a worthy cause. Be on the lookout for these common characteristics of a scam.

- Emotional appeals. Scammers may try to tug at your heartstrings by highlighting victims of natural disasters, such as wildfires or hurricanes, with an urgent appeal for donations that purportedly go towards food or shelter. Scammers commonly try to get people to act on emotion rather than logic.

- Unusual language and names. Pay close attention to the details in any request you receive – especially poor grammar and spelling errors. Scammers may try to slightly alter a real charity's name or website by changing a single letter and hoping people don't notice the difference.

- Specific payment method. Be wary if a "charity" requires you to donate through a digital payment platform or other non-refundable payment method.

Even if a charity seems real, it's important to research the organization and look for reviews. You can also do an online search for the name of the charity with the word "scam" or "complaints" to see if others have reported any issues. If you're unable to verify a charity's authenticity, you may want to donate elsewhere. When it comes to sending money, always remember to slow down and ask yourself questions. If something doesn't feel right, trust your instinct.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Fake Jobs, Phony Recruiters: Job Scams are on the Rise

Finding a new job isn't easy. It's hard to search through countless job descriptions and submit dozens of applications, so when a promising offer comes along, it's easy to be excited. But be careful. Fake postings and phony recruiters make up a growing number of scams, known as job or employment scams.

It can happen through email, social media, and on popular job sites. These scammers are generally after two things: your money and/or personal information. You can protect yourself by knowing what to look for.

Spotting a Job Scam

Fake jobs that appear too good to be true. In some cases, a scammer may post an opening appearing to be from a real company, promising a tempting salary and great benefits for little experience. Do an online search of the company, the hiring manager, or the recruiter to determine the legitimacy of the job.

Requests for money. If your potential employer asks you to send them money upfront for things like training or equipment, immediately withdraw your application. A legitimate employer will never ask you to pay for a job.

Recruiters asking for compensation. If you are approached by a recruiter asking for compensation in exchange for helping you find a job, there's a strong chance the alleged recruiter is really a scammer.

Requests for personal information. Job applications tend to require information like your name, contact information, and work experience, but it shouldn't go much deeper than that. Companies that require a background check will typically wait until much later in the interview process before asking for personal information like a Social Security Number. Similarly, never provide your banking information for setting up direct deposit until after you are hired. A legitimate company will not ask for those details on a job application.

Urgency to hire immediately. Beware of potential employers who show a sense of urgency to hire you immediately or within the same week of the application. They may want you to "seal the deal" by sending money or personal information. This urgency is to get you to act on emotion before you realize the company or job is fake. If the interview process does not include an in-person or on-camera interview, that should also arouse suspicion.

Key Takeaway

To protect yourself from a job scam, research the company and role, and reject any offer that asks for money or sensitive information upfront or promises great pay for little or no professional experience. When it comes to job scams, remember to slow down and ask questions.

To learn about other scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Threats to Turn Off Water and Power Could Be the Work of Scammers

Many basic necessities rely on utilities we take for granted. And that makes them perfect for a scammer to exploit.

Like many other scams, utility scams occur when a scammer pretends to be someone they're not. In this case, the scammer poses as a representative from your power or water company and threatens to turn off your services unless you send payment right away or provide some important personal information.

Different Approaches, Same Intent

These scams can happen through email, over the phone, via text message, and in person. In some cases, the scammer may report you've overpaid for services and ask for a bank account, credit card, or utility account information to allegedly issue a refund. Your actual utility company would already have this information. What's more likely is that the scammer is trying to get personal information to commit fraud.

Utility scams typically include an urgent notice threatening to cancel your service due to a missed payment, leaving you without heat, air conditioning, or water. Scammers use urgency to create panic and scare you into acting fast without thinking or confirming the authenticity of the situation.

People posing as utility workers may show up at your home for a fake inspection or equipment repair, investigate a supposed gas leak, or conduct a "free" audit for energy efficiency. They will try to charge you for the fake service, sell you unnecessary products, or collect personal information to use in identity theft activities.

Fast Payments Work in Scammers' Favor

Since electronic payments are a fast way to send money and often can't be reversed, the scammer may say that they need immediate payment via bank wire, gift card or digital payment apps, like Venmo or Zelle®, to keep your utilities running. These scams are often timed for maximum urgency, such as peak heating or air conditioning seasons, or right before a big holiday celebration like Thanksgiving.

How to Protect Yourself

Watch for these warning signs to detect a utility scam in progress:

- An unscheduled or unsolicited call or visit from someone claiming to represent your power or water company. No matter how great the offer or frightening the situation sounds, decline any action until you can verify its authenticity.

- Threats to cut off service unless an overdue bill or maintenance cost is paid immediately. Most utility companies send multiple notifications before canceling service.

- Requests for personal account information or payment via bank wire, gift card or digital payment apps, like Venmo or Zelle®.

If you experience any of these situations, follow these steps:

- Slow down and ask questions, like what their employee identification number is or confirm the date and amount of your most recent payment.

- Do not respond to text or email messages threatening to turn off your utilities.

- Call the utility company using the number on your bill or the company's website before taking any action. Do not use a number provided by the representative.

To learn more about scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Looking for Event Tickets? Identify Scams Before Handing Over Your Money

A packed show or competitive playoff game can make for a memorable time, but if you're scrounging for tickets, be careful. Sold-out and high-demand events like concerts, festivals, and sporting events can be prime targets for ticketing scams.

In some cases, a scammer may create counterfeit tickets, complete with forged barcodes and real company logos. At other times, a scammer might make copies of a legitimate ticket and sell it to multiple people. In either scenario, the ticket holder won't know it's a scam until their ticket is scanned at the gate and they are denied entry. Sometimes a seller will insist on upfront payment with a promise of putting tickets in the mail, but the tickets never arrive, and the seller disappears.

If tickets are being offered at a price that seems too good to be true, or if the seller is pressuring you to send money right away to seal the deal, those are warning signs of a potential scam.

How to Avoid Becoming a Victim of a Ticketing Scam

Buy only from trusted ticket vendors. When possible, purchase tickets directly from the venue. When buying online, purchase tickets from vendors you know and trust. Look for the lock symbol in the web address to indicate a secure purchasing system. You can verify their authenticity by looking them up on the Better Business Bureau or checking to see if they are a member of the National Association of Ticket Brokers.

Check the fine print. You should only purchase tickets from a seller that provides clear details about the terms of the transaction, including the location of the seats, how the tickets will be received, and what the refund policy is.

Use payment methods that come with protection. Be suspicious of sellers insisting on being paid through digital payment apps and keep in mind that certain payment types can't be refunded. A credit card is usually the best payment method for event tickets because many credit card companies offer built-in buyer protection for cardholders. Check the terms and conditions of your credit card to see what's offered.

Be wary of promotions. When you search the web for online tickets, advertisements for cheap tickets will often appear. Some of these ads will be ticket scams, especially if the prices are inexplicably low.

If you're unsure, verify your tickets. Pay a visit to the arena where the event will be held. Present your ticket at Will Call or customer service, and they can verify if your ticket is legitimate.

When it comes to ticketing scams, remember to slow down and ask questions. If you detect suspicious activity, report the seller to your online marketplace or ticketing platform.

To learn more about scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Online Marketplace Scams Target Both Buyers and Sellers

Whether you're looking for a houseplant, a coffee table, or a new gaming console, online marketplaces can be great places to start. But be careful. Anonymous listings and virtual transactions are ripe for online marketplace scams, which can take a variety of forms.

You May Not Get What You Paid For

If you pay in advance for something you have not seen in person, the item may not arrive as advertised. In fact, it may not arrive at all. A picture of a cute puppy or designer jewelry is easy to post in a marketplace, but if you pay without knowing the seller personally or seeing the product, the seller can take your money and disappear.

Payment Type Matters

Pay attention to listings that insist on an unusual payment method, such as gift cards. Gift card numbers are hard to trace, so if you don't get what you paid for and the seller's profile has disappeared from the marketplace, it will be very difficult to track them down or get your money back. Also keep in mind that with many digital payment methods, once you send a payment it often can't be reversed, making it even more important that you know who you are dealing with and what you are buying.

Scams Targeting Sellers

While many people are aware of scams targeting buyers on marketplace sites, sellers can get scammed too. One tactic is for scammers to fake payment receipts or confirmations with an amount that's higher than the asking price. The supposed buyer may claim to have purchased a product above your listed price and request a refund without actually having placed an order.

Another marketplace scam growing in popularity involves a fake email appearing to be from Zelle®, claiming that a transaction cannot be completed until your Zelle® account is upgraded. In reality, the scammer is tricking you into paying them for an upgrade that doesn't exist. Zelle® does not offer account upgrades.

Warning Signs – What to Watch For

- Unreasonably Low Prices: Sometimes an incredibly low price is literally too good to be true. In most instances, it's best to pass on this type of offer unless you can inspect the product in person and ensure its authenticity.

- Sales Pressure: If the seller creates a sense of urgency by warning that the item won't last long or many others are interested, take your time and think it through. Creating urgency is a technique to get you to act on impulse instead of logic, and it could lead you to overlook something suspicious.

- Fake Profiles: Keep an eye out for telltale signs of a false profile, like a generic profile picture, only one friend or connection, or a profile name that does not match the name or email address on the invoice.

Slow Down, Ask Questions

When it comes to making safe marketplace purchases, remember to slow down and ask questions. If you detect suspicious activity, report the user to your marketplace platform.

To learn more about scams and ways to protect yourself, visit www.bcbonline.com/home/resource/security and www.zellepay.com/pay-it-safe.

Beware of Phishing Schemes

Using Zelle, Cash App, Venmo, or any other money transfer service is safe as long as you are only sending money to friends, family, and others you trust.

Scammers want to be someone you trust, so they craft all types of scenarios to make you believe they are really working to help you. In the end, they only want to manipulate you into authorizing money transfers for their benefit.

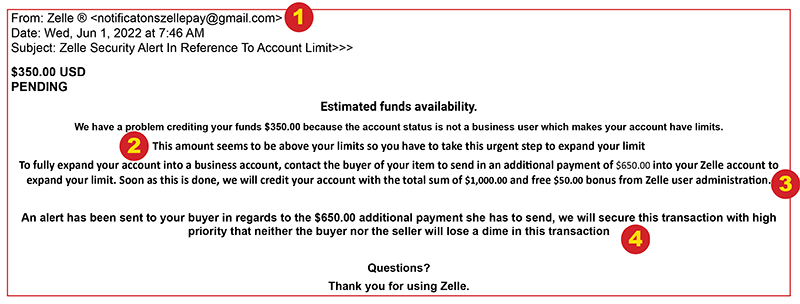

Here's an example of a fraudulent e-mail message along with tips on spotting red flags:

- Check the sender. Financial institutions have their own e-mail domain names. They do not use free services like Gmail, Outlook, or Yahoo to send e-mail messages to customers.

- Look for urgent or pushy messages. Scammers will create a sense of urgency in an attempt to get you to respond swiftly. This tactic is not for your benefit. It's solely to help them pull off a scam before you realize the message is fraudulent.

- Take note of unusual requests. Be wary of any message you receive about transferring money to make something happen. In this example, the sender says to request an additional payment in a very large amount from the buyer. That is very strange, and no legitimate business would make such a request.

- Check for poor grammar, spelling, punctuation, and formatting. A tell-tale sign of a phishing e-mail is poor grammar and punctuation throughout the message. The run-on sentence in the example is hard to understand. An occasional typo may appear in real e-mail messages from businesses due to human error, but the overall message will not be poorly-crafted with inconsistent punctuation.

If you're ever in doubt about an e-mail message you received, please contact your local banker to talk about it first before acting on it. The extra time spent being cautious could save you from being scammed.

NOTE: Benchmark does not offer Zelle for business accounts as suggested in the e-mail example.

How to Take Back Control of Your Data

From social media to online shopping, our lives and the digital world become more and more intertwined every day. And while the digital world has afforded us a whole new level of convenience and access to information, it is imperative that consumers remember the best practices for protecting their personal data and ensuring it is being used the right way.

By 2020, it was estimated that 1.7 MB of data was generated by every individual worldwide every second. This includes data about an individual's activities, behaviors, and interests. Data comes in many forms; there is personal data, like social security and driver's license numbers and there is physical data, like health data. With all of this digital activity and data flying around it is easy for individuals to feel like they have lost control of their data.

Consumers are rightly becoming increasingly concerned with data privacy, with 86 percent of individuals saying that they care about their data privacy. That said, even the savviest digital users can have trouble managing their data. Here are a few steps to better manage your personal information and make informed decisions around your data and how it is being used.

Understand the privacy/convenience tradeoff

Many accounts ask for access to personal information, such as your geographic location, contacts list, and photo album, before you even use their services. This personal information has tremendous value to businesses and allows some to even offer you their services at little to no cost.

Make informed decisions about whether or not to share your data with certain businesses by considering the amount of personal information they are asking for and weighing it against the benefits you may receive in return. Be thoughtful about who gets that information and wary of apps or services that require access to information that is not required or relevant for the services they are offering. Delete unused apps on your internet-connected devices and keep all apps secure by performing updates.

Manage your privacy

Once you have decided to use an app or set up a new account, check the privacy and security settings on web services and apps and set them to your comfort level for information sharing. Each device, application, or browser you use will have different features to limit how and with whom you share information. That said, with so many different settings to manage it can be very challenging to stay on top. However, here are a few important ones to focus on first:

- Geolocation Data: In order to provide more relevant results, many apps will ask for you to share your location data with them. Make sure that you are only sharing this data with apps you trust and that these apps are using your data in a responsible way.

- Contacts Data: Email apps and video conferencing apps virtually all allow for individuals to automatically sync their existing contacts with their services. Therefore, it is important that you share this data only with trusted sources as not only is contact data yours, but it is your friend's and family's as well.

- Camera and Photo Data: Social apps universally ask for access to an individual's photo library and related camera data—which obviously contains troves of private information. Be sure only the most trusted sources have access to this information and also double-check settings in the app to filter which photo files apps have access to.

You can find more information for free through resources like the National Cybersecurity Alliance's Manage Your Privacy Settings page.

Protect your data

Data privacy and data security go hand in hand. And fortunately, there are numerous easy-to-implement steps that everyday individuals can take to shore up their data and general cybersecurity:

- Long, Unique Passwords: Thanks to automation, once a bad actor has compromised one password, they can easily bounce it around other sites to gain access to other accounts. Having long, strong, and unique passwords for each account immediately thwarts these "easy hacking" efforts and makes it much harder for hackers to crack a password in the first place.

- Password Managers: Password managers have redefined cybersecurity for individuals by providing a consolidated and secure hub for individuals to store their information. Password managers can even generate unique, secure passwords for you, and store them automatically.

- Multi-Factor Authentication (MFA): MFA has been found to block 99.9 percent of automated attacks when enabled and can ensure your data is protected, even in the event of a data breach. And the great news is, many organizations are increasingly offering it to individuals as an opt-in—if not mandating it completely—so it is easier than ever to enable.

Keeping these quick tips in mind can help you keep much better tabs on your data and create a safer digital environment for yourself.

Phishing, Vishing, and Social Engineering

These types of attacks are used in an elaborate scheme intended to trick victims into taking specific action to defraud them. Phishing, vishing, and social engineering can come through any communication channel including telephone/voice, SMS, chat, e-mail, postal mail, Internet, social media, and others.

The following best practices can be implemented to protect yourself from these scam attacks:

- Do not respond to any unsolicited multi-factor authentication (MFA) requests.

- Do not divulge your credentials (username and password) or MFA verification code to anyone.

- If you suspect you've been part of a phishing, vishing, or social engineering attack, notify your financial institution.

- Change your username & password periodically and use strong passwords.

- Use complex and unique passwords for ALL types of online accounts consisting of at least 12+ characters, including special characters and numbers.

Creating a Password

Still using your dog's name as your password? Creating a strong password is an essential step to protecting yourself online. Using long and complex passwords is one of the easiest ways to defend yourself from cybercrime. No citizen is immune to cyber risk, but you can minimize your chances of an incident.

SIMPLE TIPS:

Creating a strong password is easier than you think. Follow these simple tips to shake up your password protocol:

- Use a long passphrase. According to National Institute of Standards and Technology guidance, you should consider using the longest password or passphrase permissible. For example, you can use a passphrase such as a news headline or even the title of the last book you read. Then add in some punctuation and capitalization.

- Don't make passwords easy to guess. Do not include personal information in your password such as your name or pets' names. This information is often easy to find on social media, making it easier for cybercriminals to hack your accounts.

- Avoid using common words in your passwords. Substitute letters with numbers and punctuation marks or symbols. For example, @ can replace the letter "A" and an exclamation point (!) can replace the letters "I" or "L."

- Get creative. Use phonetic replacements, such as "PH" instead of "F". Or make deliberate, but obvious misspellings, such as "enjin" instead of "engine."

- Keep your passwords on the down-low. Don't tell anyone your passwords and watch for attackers trying to trick you into revealing your passwords through email or calls. Every time you share or reuse a password, it chips away at your security by opening up more avenues in which it could be misused or stolen.

- Unique account, unique password. Having different passwords for various accounts helps prevent cyber criminals from gaining access to these accounts and protect you in the event of a breach. It's important to mix things up—find easy-to remember ways to customize your standard password for different sites.

- Double your login protection. Enable multi-factor authentication (MFA) to ensure that the only person who has access to your account is you. Use it for email, banking, social media, and any other service that requires logging in. If MFA is an option, enable it by using a trusted mobile device, such as your smartphone, an authenticator app, or a secure token—a small physical device that can hook onto your key ring. Read the Multi-Factor Authentication (MFA) How-to-Guide for more information.

- Utilize a password manager to remember all your long passwords. The most secure way to store all of your unique passwords is by using a password manager. With just one master password, a computer can generate and retrieve passwords for every account that you have – protecting your online information, including credit card numbers and their three-digit Card Verification Value (CVV) codes, answers to security questions, and more

Sending Money Safely with Zelle®

Zelle® is a fast, safe, and easy way to send and receive money with people you trust, like your babysitter, coworkers, your fellow PTA mom, or your son's soccer coach. Whether you just enrolled with Zelle® or have been an active user for a while, there are a few tips you should always keep in mind to ensure you are being safe when sending money.

Only send money to people you know and trust. Money moves fast with Zelle®, directly from bank account to bank account within minutes*. So, it's important you know and trust the people you're sending money to.

Why? Because you can't cancel a payment once it's been sent if the recipient is already enrolled with Zelle®. And if you send money to someone in advance for a product or service you don't end up receiving, you may not get your money back.

Beware of payment scams. If you receive a call from someone threatening a negative action, such as fraud on your account or utilities being shut off unless you make a payment with Zelle®, slow down and think it through. This might be a scam. Scammers use fear and urgency to get people to act on impulse rather than reason. Also, keep in mind that no one from Benchmark Community Bank will ever ask you to send money with Zelle® as a test or to avoid a fraud event. Another example of a payment scam is buying event tickets from a stranger at a price that seems too good to be true and then never receiving them. If the seller asks you to use Zelle® to purchase the tickets, you should refuse unless the seller is someone you personally know and trust.

Neither Benchmark Community Bank nor Zelle® offers purchase protection for payments made with Zelle®—for example, if you do not receive the item you paid for, or the item is not as described or as you expected.

Treat Zelle® like cash. Did your friend change phone numbers recently? It's easy for people to change their phone number or email address. Always make sure the name that appears on the confirmation screen matches the intended recipient. When in doubt, contact the recipient to verify the U.S. mobile number or email address they used to enroll with Zelle® before you hit "Send."

Remember, if a person has already with Zelle®, you can't cancel the transaction, so it's important you get it right the first time. If you send money to the wrong person, it's like handing cash to a stranger.

For more information and videos on how to use Zelle® safely, visit "How to Pay it Safe with Zelle®."

*U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Best Practices for Mobile Apps

The number of fraud attacks using fake mobile applications are on the rise. While there is no single solution to counter fraud attacks, the following best practices can be implemented to mitigate fraud risk for mobile applications:

- Install mobile malware protection software.

- Avoid connecting to unknown wireless networks.

- Avoid links or software downloads from unknown sources.

- Install application/software/updates from legitimate app-stores only.

- Turn off additional mobile features that are not being used.

- Turn off or limit geolocation features for applications that do not require them.

- Use passcodes and screen lock timers to protect mobile devices.

- Keep smart-phone software/firmware, system patches and upgrades up-to-date.

- Be aware that "jail-breaking" or "rooting" increases the risk of compromise for mobile devices.

- Read reviews about the application developers and publisher to determine app credibility.

- Review and understand the permissions required when downloading/installing applications.

Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. And in this time of expanded use of online banking, the problem is only growing worse. In fact, the Federal Trade Commission's 2022 report on fraud estimates that American consumers lost a staggering $2.6 billion to these imposter scams in 2022 alone. Imagine where we are today.

It's time to put scammers in their place.

Online scams aren't so scary when you know what to look for. And at Benchmark Community Bank, we're committed to helping you spot them as an extra layer of protection for your account. We've joined with the American Bankers Association and banks across the country in a nationwide effort to fight phishing—one scam at a time.

We want every bank customer to become a pro at spotting a phishing scam—and stop bank impostors in their tracks. It starts with these four words: Banks Never Ask That. Because when you know what sounds suspicious, you'll be less likely to be fooled.

These top 3 phishing scams are full of red flags:

- Text Message: If you receive a text message from someone claiming to be your bank asking you to sign in, or offer up your personal information, it's a scam. Banks Never Ask That.

- Email: Watch out for emails that ask you to click a suspicious link or provide personal information. The sender may claim to be someone from you bank, but it's a scam. Banks Never Ask That.

- Phone Call: Would your bank ever call you to verify your account number. No! Banks Never Ask That. If you're ever in doubt that the caller is legitimate, just hang up and call the bank directly at a number you trust.

You've probably seen some of these scams before. But that doesn't stop a scammer from trying. For more tips on how to keep phishing criminals at bay, including videos, an interactive quiz and more, visit BanksNeverAskThat.com. And be sure to share the web page with your friends and family.

What's Your Scam Score? Take five minutes to become a scamspotter pro by taking the #BanksNeverAskThat quiz at BanksNeverAskThat.com. Share your score to encourage your friends and family to test their scam savviness, too. The more scamspotters out there, the harder it is for phishing criminals to catch their next victim!